Something that wasn’t possible when I bought my first home was the option of building a second dwelling on the property that I could rent out.

It’s one of the greatest opportunities ever created for any homeowner, but in particular first homebuyers and empty nesters.

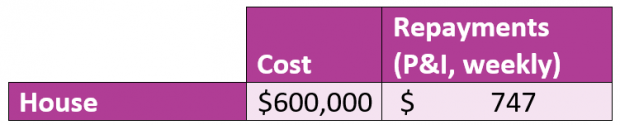

Let’s say you bought a property today for $600,000.

The interest repayments (principal and interest) on a 90 per cent loan would come to $747 per week.

Repayments on $600,000 house at 90 per cent loan to value ratio (LVR), interest rate 6 per cent p.a.

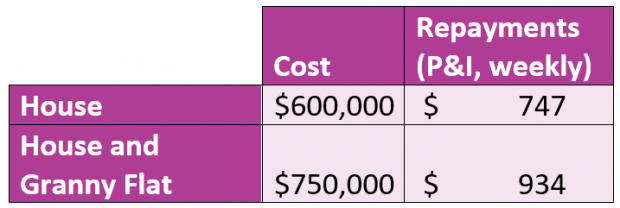

Now let’s say you bought the $600,000 property but added a granny flat to the property as well.

The Granny Flat would cost you another $150,000, meaning your total cost comes to $750,000.

As shown in the table, by comparison the repayments on a 90 per cent loan would come to $934 per week.

Repayments on $600,000 house, and $750,000 house with Granny Flat, at 90 per cent loan to value ratio (LVR), interest rate 6 per cent p.a.

While the repayments and upfront commitment are higher, you would also be getting an extra $420 per week in rent coming in from the second dwelling.

As a result, the mortgage costs you $514 each week once you factor in the rent:

Repayments on $600,000 house, and $750,000 house with Granny Flat, at 90 per cent loan to value ratio (LVR), interest rate 6 per cent p.a. after rent is factored in.

It’s a no brainer. If I was a first home buyer, I’d build the granny flat and rent it out, but make the same net repayments (i.e., interest plus some principal) each week.

Let me show you what I mean by that:

Repayments on $600,000 house, and $750,000 house with Granny Flat, at 90 per cent loan to value ratio (LVR), interest rate 6 per cent p.a. after rent is factored in.

This is where it starts to get really cool. 620

By making the same net repayments, like I have set out in the table above, you would pay the loan off 11 years and 3 months earlier.

At the same time, you would end up paying $138,000 less interest over the lifetime of the loan than if you’d just bought the house.

Granted, you’d have to come up with an extra $15,000 as a deposit to build the granny flat, but it pales into insignificance to the benefits. I also haven’t factored in the fact that rents historically grow by 2 per cent above inflation, compounding. The rent being paid in 20 years’ time would be closer to $920 per week!

For empty nesters, this is an incredible opportunity. Imagine getting an annual income of $20,000 a year in today’s terms, growing to $45,000 in time. That’s more than the pension!

Yet secondary dwellings are not very common today, with most being built by investors seeing the opportunity to get a 6 per cent or higher rental yield.

Councils and State Governments have also put up unnecessary roadblocks. Outside of New South Wales and Queensland, it’s prohibited to have a second dwelling on your property unless it’s rented to a family member.

Where it is permitted in New South Wales and Queensland, it’s been made more difficult than it needs to be. For example, in Logan City you can only have a second dwelling on your property if the block of land is at least 15m wide and has an area of 450m2 or greater. Outside of that, you must go through an uncertain approval process that includes unnecessary requirements like providing five car park spaces and paying government infrastructure charges.

I’m sure it’s only a matter of time before governments make the process easier, and it becomes mainstream for first home buyers and empty nesters.

If we were going to see secondary dwellings become more mainstream, it would be at a time where we have a cocktail brewing comprised of the biggest housing shortage ever seen in Australia (which is pushing rents even higher), an explosion of overseas migration (which means it won’t stop any time soon) and higher interest costs (which can be offset by getting someone to pay you rent).

Time will tell!