There has been a lot of discussion of late about superannuation. I believe that every Australian should be able to access their super early so that they can make a deposit on their first home.

I am a huge fan of our country’s superannuation system. As it stands, employers currently pay 11 per cent of an employee’s wage into their chosen superannuation fund, and that money is invested on their behalf.

As of July 1, 2025, this figure will rise to 12 per cent.

It’s a similar premise to the Bulletproof Investing ‘pay yourself first’ tip.

BULLETPROOF TIP: Pay yourself first

Set up an automatic transfer the day after payday that sends 10 per cent of your after-tax pay into a separate bank account with a different banking institution. That bank account is for your future self, to be invested and multiplied to grow your wealth.

Most Australians find it hard to spend less than they earn let alone save 10 per cent of their after-tax pay.

The superannuation system effectively does this for us, as the money never makes its way into our hands in the first place.

If that’s the case, why not allow that money to be accessed and go toward a deposit on a first home you may ask?

Buying a property is the biggest investment most Australians makes in their lifetime. In fact, 56.2 per cent of all wealth in Australia is tied up in property. It’s also the only way you can make money in Australia and not pay tax, with profits generated on the sale of our home considered tax-free.

This raises another question – what’s the point in having all this money in our super funds if we don’t own our own home? It is our money after all, right?!

This is particularly the case at the moment with rents around Australia growing by 8.5 per cent per annum, making it even harder to spend less than we earn and save for a housing deposit.

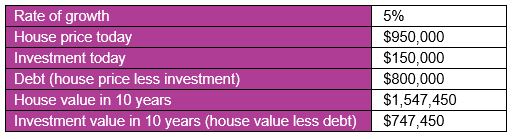

According to the Retirement Trust, the typical 35-year-old Australian couple has $150,000 in superannuation. This works out to be a 15 per cent deposit on the median house price in Australia, which is just over $950,000.

The argument against using superannuation funds for the Great Australian Dream is that doing so takes away from the retirement nest egg.

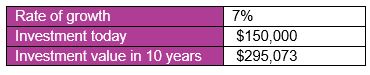

I have to say, for me that doesn’t make sense. According to the AFR, Superannuation funds will, on average, generate a return of 7 per cent after fees.

What this means is that a $150,000 super balance will grow to be worth $295,000 in 10 years.

Table 1: Change in value of typical Australian couple super fund in 10 years.

House prices will generate the same, if not better returns, than our super funds. On top of this, the return is leveraged because we are borrowing the balance.

Even if we were to be conservative and assumed that the median house price grows by just 5 per cent per annum, the $150,000 investment would be worth nearly $750,000, which is more than double what it would be if we left it in our super fund:

Table 2: change in value of typical Australian couple super balance if invested in their own home.

Like everything, there might need to be some qualifications around the rules, but essentially the basic concept works.

The Government has a watered-down version of this currently on offer. It’s called the First Home Super Saver Scheme, but you can only access up to $50,000 and according to the rules that amount needs to come from contributions you have made over and above those made by your employer.

Perhaps more importantly, though, $50,000 won’t get you very far in a place like Sydney where the median house price is $1.4 million and growing by $100,000 per year.

The Australian dream is to own our home. The biggest investment most Australians make is their own home. The biggest barrier to buying the first home is saving a deposit.

Let it be said that superannuation is the ideal solution to stop the dream from fading.